Portfolio Review for the week of 14 - 20th June 2021

Dear friends

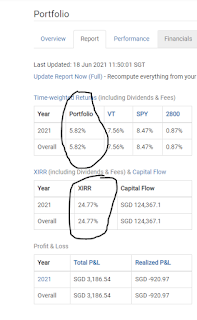

This is the update of my model portfolio that started on 23 March 21. The portfolio has risen from 4.94% to 5.82%. The main driver appears to be the US, which is the strongest stock market in the world today. The S&P500 is up 8.5% (last week was 7.1%), Vanguard Global Stocks up 7.6% (from 6.7% last week). Hong Kong tracker fund crept up from 0.4% to 0.9%. XIRR is 24.77% for the model portfolio, from 21.3% last week. Overall, I detected a rotation out of mining and banks into tech. I will be looking at taking some profit (only if there is) out of Blackrock World Mining and Fidelity Global Financials and into Polar Capital Tech, Blackrock World Technology. This is for my own risk profile and investment objectives, please note.

Below is the equity curve. While we are outperforming China, we are lagging the S&P500. Since I’m investing mainly in the US, China and Singapore, the only way I can catch up with the S&P500 is through stock picking and timing. It is indeed a daunting task.

The weights towards USD stocks increased from 76.5% to 79.1%. SGD stocks fall from 9.7% to 8.2%. HKD stocks from 13.6% to 12.6%. The over-weight in US is based on the momentum. China appears to face some headwinds due to the central bank curtailing loans growth but I will not be cutting losses.

Top performing stocks to date:

- Shorting of Microstrategy. Up 79.1%.

- Moderna up 18.1%.

- Facebook up 15.7%

- S&P Global up 15.5%

- A50 ETF, UBS China A Opportunity or JPMorgan China A Opportunity up 11.4%.

Worst performers which are generally improving.

- Shanghai International Airport down 17.1%.

- Alibaba down 11.9%

- Ping An Insurance down 11.6%

- JD.com down 11%.

- Applied Materials down 9.3%.

Additions / Subtractions from the portfolio. Just minor tweaks

- Sold half position in MSCI Global Metal ETF or Blackrock World Mining. Momentum faded and rotation coming in, out of financials and mining, back to tech.

- Close another half of my shorts on MicroStrategy as I think Bitcoin has bottomed for now.

- Lemonade, added position. US online insurance. Turnaround of stock.

- Sold ¼ of IHF, iShares US Healthcare ETF.

- Added ¼ of S&P Biotech ETF (Wellington Healthcare Fund)

- New position, added ½ position in Service NOW. This is in BOS’ High Conviction List.

- Added ¼ position to Amazon. Also in BOS’ High Conviction List.

- Added ¼ position to Adobe.

- Sold ¼ position on UnitedHealth Group.

Portfolio attribution.

In the last 30 days, portfolio is up 4.6% v S&P 500 up 2.4%, vs Vanguard Total World Stock up 2.4%, vs Tracker Fund of HK up 0.4%.

Biggest positive contributors

- Lemonade up 34.3%.

- SEA Ltd up 24.2%

- Veeva Systems up 21%

- Amazon up 8%

- Adobe up 14.7%.

- China A50 ETF down 2%

- Microstrategy

- Silver (sudden pullback) SLV ETF.

- Gold (sudden pullback presents buying opportunity). Blackrock World Gold or GLD ETF.

- MSCI Global Metals ETF (Blackrock World mIning).

Comments

Post a Comment