Tech Sell Off Has Begun

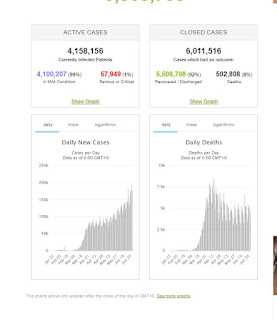

The second wave has begun. Make no mistake. Some cities are going to lock down again. https://www.youtube.com/watch?v=sV5dh1W80Zc https://www.cnbc.com/2020/06/25/countries-unlikely-to-impose-full-lockdowns-if-theres-second-wave-analysts-say.html I doubt countries wil lgo through a full lock down like the first time. But it could be serious. I mentioned in my earlier posts that infections are rising again, particularly in the Americas. But surprisingly, the "serious" cases have fallen to 1% out of 99%. Death rates have held steady and I was hoping for the virus to mutate to something less deadly. The second wave for Spanish flu was especially deadly, where most of the deaths occurred. I suspect as hospitals become overloaded with patients, a "limited" lock-down will happen in affected cities. This is to "flatten the curve" due to limited hospital capacity. Death rates should climb but I doubt it will be greater than what we saw in the fi...