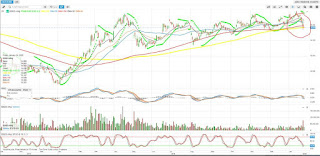

Wuhan Virus and Stock Market Impact

It has been an eventful two weeks. I’ve hinted of a “significant correction” of between 6 to 10% in the coming weeks. Refer to my email on 9 Jan 20, also on 6 Jan 2020. Lessons to learn: 1. Nothing goes up forever and what goes up exponentially must come down fast. Take for example Bitcoin. It shot up from USD3000 to 20k. It promptly fell and gave up all the gains. All patterns repeat. 2. Stocks rise slowly but fall very swiftly. It had to happen and this Wuhan virus is a trigger. The supports for all stock markets and stocks are at around the 150 to 200 days moving averages. They generally are on the uptrend so I presume this bull rally is intact. Most of my clients have taken some profit starting from last week till today. For China, the 2823 HK ETF is already at the 200 days MA and I don’t think we should sell now. In fact we should get ready to buy swiftly. Think of all the st...