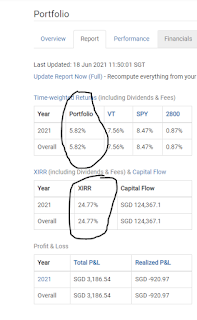

Dear friends This is the update of my model portfolio that started on 23 March 21. The portfolio has risen from 4.94% to 5.82%. The main driver appears to be the US, which is the strongest stock market in the world today. The S&P500 is up 8.5% (last week was 7.1%), Vanguard Global Stocks up 7.6% (from 6.7% last week). Hong Kong tracker fund crept up from 0.4% to 0.9%. XIRR is 24.77% for the model portfolio, from 21.3% last week. Overall, I detected a rotation out of mining and banks into tech. I will be looking at taking some profit (only if there is) out of Blackrock World Mining and Fidelity Global Financials and into Polar Capital Tech, Blackrock World Technology. This is for my own risk profile and investment objectives, please note. Below is the equity curve. While we are outperforming China, we are lagging the S&P500. Since I’m investing mainly in the US, China and Singapore, the only way I can catch up with the S&P500 is through stock picking and timing. It