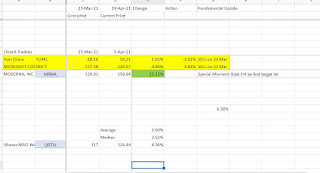

My Model Portfolio Update 19 Apr 21

Dear all

I humbly share with you my stock list. Obviously, I have another list for unit trusts which I will share later.

It is as of 14 Apr so I haven’t updated some positions. The date where positions were added is in column C. This is not a recommendation and what I buy may not be suitable for you. For example, Moderna, Micron, Applied Materials, Lam Research, KLA Corp are momentum plays. Those of you who don’t like to trade may not find them suitable. ARKG and ARKK are my small exposures into the “venture capital” word. Those of you who prefer large cap, established names may not like ARK. The REITs are for income. Those who want a growth-focused portfolio may not find it suitable.

Examples of top performing trades

- Moderna. Opened position on 5 April. I took profit yesterday by selling ¼ of my position at a 21.8% profit.

- McDonald’s. Up 9.5%.

- S&P Global Inc. up 7.5%.

- Facebook up 6.6%.

- YUM Brands. Up 6.2%. I am considering to sell ¼ of my position of this stock since it has risen a lot.

Detractors:

- I crystalised a loss on Microsoft by closing my sell position and turn it into long. The loss was 4.8%.

- Microstrategy, which I sold half of it much earlier is up 17.8% and hence I treat as a loss of 17.8%.

- JD is down 4.5%. I am still holding and will NOT cut loss. This is for the long term and is in BOS’ conviction list.

- Applied Materials, my momentum trade is down 5.6%. I’m still holding. It’s early days yet.

- Shanghai International Airport, which is a mean reversion, undervalued play, is down 4.3%.

I am not worried about losses. The whole portfolio is up about 1.4% from 23 Mar 2021. If you hold on to fundamentally good stocks, they will eventually turn into a profit. Every good company will have its turn to shine.

thanks for transparency and clear basis!

ReplyDelete