My Track Record for CPF Investments

This is the track record of my CPF investments. Some of you mentioned that “I cannot apply to me”. Well, if you want a live feed of my investments and follow along, I can send them to you, at your own risk. If you enter at a different timing, do not take up all the suggestions, then the result will be different. But it serves as a reference of how you can make money. Results will always be different due to the decisions you make, your temperament. I have several accounts for different sorts of investments so this is purely for CPF. I do NOT invest in Singapore shares as I believe it is too slow and we DO NOT have world beaters in our midst. The best companies are either listed in HK or the US. So I use unit trusts to reflect my thoughts.

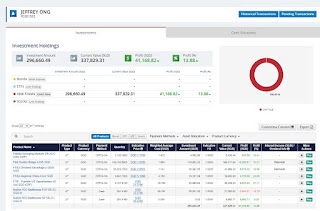

This is my holdings for Fundsupermart. The unrealised profit is roughly 13.88%. Almost every fund except H2O Multibonds is in double digit profits. I bought them in 2020. I will show you the historical transactions.

The profit as circled below is 84,161.17. This is realised and unrealised. Unfortunately FSM cannot provide calendar returns but I believe they are getting higher as my skills improve. Against an initial capital of 454,331.33 – 200,663.18 ( I withdrew money for property investments and other things), = 253,668.15 is the baseline. The return is 33.18% (84,161.17 / 253,668.15). However, it is more important to know when I started investing.

You can see that my earliest entries was on 28 Aug and 12 Sep 2014 when I started with a tiny amount of S$52,000.

Assume that I built up the portfolio over time, the invested capital is half of 253,668.15. That means my average invested capital is 126,834.075. Add back my profit of 84,161.17, I will arrive at a present valuation of 210,995.25. The annualised return over 6 years is about 8.85% CAGR. That’s not a great performance, but you need to consider that this is a BALANCED mandate. A huge part of my portfolio is from CPFSA, which allows me to buy only First State Bridge (now First Sentier). About 35% of my portfolio is in First State Bridge. Since FS Bridge is 50% into bonds, at any time, my portfolio can only have 83% into equities, the rest in bonds.

How did I perform against the index? From 28 Aug 2014 to now, MSCI World index achieved 7.7% per year. The Barclays Global-Aggregate Total Return Index achieved 2.21% per year. If I use a blended 83% MSCI World and 17% bonds index, I get (0.83 X 7.7) + (0.17 X 2.21) = 6.77% per year. So my returns, although not great from my own standards, is 8.83% and that is 2.06% alpha. I have beaten the blended index, after fees by on average 2.06% per year!

Let’s dissect my trades this year. They have been far from perfect. But the key is I persisted, learn a lot and improve myself. From Jan 2020 onwards I began to take profit and switched to LionGlobal Short Duration Bond Fund.

I went in at the 50 days moving average support too early, around mid feb. I thought the correction will NOT be over 15%. That the pandemic will not have that great an impact.

Around 12 Mar onwards I realised that the drawdown will be greater so I switched again to LG Short Duration. In fact by first week of April I was still switching the LG Short Duration. But I saw 2 things: 1. Central banks world wide announced money printing and fiscal support at unprecedented levels. 2. Daily MACD turned positive.

I gradually added back positions into US, Asian equities from 22 April. I was cautiously bullish. Note that these are my personal investments, and NOT in accordance to House views. So please do your homework. If you want my personal views, do specifically ask me for that. I continued to add on risk until I was fully invested in equity funds to the maximum capacity.

Obviously, it was not perfect. 1. I entered to equities too early, somewhere in mid Feb. 2. I was too gradual in entering equities from April onwards. 3. If I had DONE NOTHING and held on, I would have performed better. But the key is to manage your own emotions. Do not let fear dictate your actions. There will be mistakes along the way but if you can remove your emotions from investing, you will do well.

Comments

Post a Comment