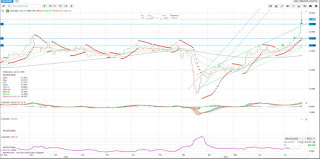

XAGUSD Shoots Up!

When I suggested buying XAGUSD at around USD17.50, it is now USD21.20. I think it will rise much more, perhaps to as high as USD45 / oz. But in the short term, it has risen too much too soon and if you have a big portion suggest you take profit by selling ½ or ¼.

Silver prices soar to six-year high on ‘green recovery’ bet

Precious metal outshines gold with a 70% rise since its March low

The price of silver can enjoy explosive spurts when conditions are right © Kerem Uzel/Bloomberg

Top of Form

Save

Bottom of Form

Neil Hume, Natural Resources Editor

YESTERDAY

Silver prices have touched their highest level in six years, encouraged by low interest rates on other long-term assets as well as hopes that the industrial metal will be a winner in the “green recovery” promised by politicians.

The price of the metal rose as much as 6 per cent to $21.17 an ounce on Tuesday afternoon — the highest in intraday trading since July 2014 — before falling back slightly. The price is now more than 70 per cent above its March low, outpacing gold, which is up about 24 per cent to a nine-year high above $1,800 an ounce.

Silver, which has a lively following among retail investors, can enjoy explosive spurts when conditions are right. Catalysts typically include a pick-up in manufacturing demand and loose monetary policy, which increases its relative attraction as a store of value.

“We see both of these factors driving silver higher over the next 6-12 months,” said analysts at Citi this week. The bank expects the price to hit $25 an ounce by the middle of next year.

Industrial applications, including electronics and photovoltaic cells used in solar panels, account for about 55 per cent of silver demand, according to RBC Capital Markets. This contrasts with gold, where investment makes up a far larger proportion of demand, making its price more susceptible to swings in sentiment.

Investors have picked silver as a way to play this “green” recovery, said Colin Hamilton, analyst at BMO Capital Markets. Governments across the world have approved more than $50bn of environmentally friendly stimulus measures this year, according to BMO. Meanwhile, Joe Biden, the US Democratic presidential nominee, has put clean energy at the centre of his $2tn plan to revive the US economy.

This green focus has been reflected in investment flows. Holdings of silver in physically backed exchange traded funds are up a record 35 per cent since the start of the year to 820m ounces, or about $17bn, according to Eikon data. Gold holdings in such ETFs, by contrast, are up just 26 per cent. This “velocity” of inflows should continue through the third quarter, lifting prices and silver-linked equities, said Mr Hamilton.

Shares in Fresnillo, the Mexico-based silver producer listed in London, have risen almost 70 per cent this year, making it the best performer in the FTSE 100. Mid-cap peer Hochschild is up about 40 per cent.

Silver bulls point to the gold/silver ratio as evidence that the rally has further to run. This reached an all-time peak in March at 125, but has fallen back below 100 as silver’s run has outshone gold. However, it remains above its long-run average of 66.

Some analysts see threats to industrial demand. RBC has warned of lockdown-related delays to large solar projects. In a recent report prepared for the Silver Institute, consultancy CRU predicted demand from the photovoltaic industry would decline from its 2019 peak of 100m ounces, because of new manufacturing techniques that require less silver.

Markets

Gold Nears Record, Silver at Six-Year High on Spur From Stimulus

By

and

July 21, 2020, 6:57 PM GMT+8 Updated on July 22, 2020, 3:14 AM GMT+8

·

Silver futures are up 16% this month, outpacing gold’s gain

·

Precious metals are soaring to multi-year highs on the back of persistent concerns over the coronavirus and the outlook for further economic stimulus worldwide.

Gold futures surged to an almost nine-year peak and silver touched the highest since 2014 after Hong Kong reported additional cases of the virus and new infections in the Australian state of Victoria surged, fueling demand for haven assets. European Union leaders agreed on an unprecedented stimulus package to pull their economies out of a virus-induced recession. Silver, used in manufactured products ranging from solar panels to electronics, is getting an added boost from supply concerns and bets on a rebound in industrial demand.

The two metals are the top performers in the Bloomberg Commodity Index this year as investors clamor for insurance against further economic fallout from the virus. Low interest rates amid easy monetary policies have also bolstered the appeal of the non-interest-bearing assets. The jump in demand has sent holdings in exchange-traded funds backed by the metals to all-time highs.

“For gold it’s the same old story: Real rates continue to grind lower and we are reaching levels close to the global financial crisis,” Daniel Ghali, TD Securities commodities strategist, said by telephone. “We’ve seen that silver has been increasingly trading as an industrial metal. We think the marginal unit of demand for silver is coming from the industrial metal side.”

Gold futures for August delivery rose 1.5% to settle at $1,843.90 an ounce at 1:30 p.m. on the Comex in New York, the highest closing price for a most-active contract since September 2011. Gold futures are less than $100 away from the all-time high of $1,923.70 set that year.

Silver for September delivery jumped 6.8% to settle at $21.557, the highest since March 2014. Other precious metals also advanced on Tuesday, with palladium futures gaining 3.7% on the New York Mercantile Exchange and platinum climbing 7.1%, the most since April.

Even after recent gains, there’s a long list of banks and traders predicting silver will keep rising as investors continue to pile in. Citigroup Inc. said in a report this week that it sees prices rising to $25 in the next six to 12 months, with the potential for $30 based on the bank’s bull case.

“Silver is now leading the charge,” said Stephen Innes, chief market strategist at AxiCorp Ltd. The metal is following the same trajectory as during the global financial crisis, he said. Back then, prices dropped during the worst of the crisis before rallying to fresh records near $50 by 2011.

— With assistance by Isis Almeida

Looking at the S&P500 chart, I think it will come down and rise to a new high. It appears to have broken above the resistance and may retest the pre Covid high. My goodness! All this money printing.

EU is finalising a EUR750 bio recovery fund, with EUR390 bio non-repayable grants! OMG. That’s manna from heaven!

Second stimulus check in the US.

That’s why there’s no point saving money now. The balance sheet has risen by 200% in the US but my pay check is still stuck!!!! What’s the point of saving? I must borrow more money because interest rates are so low, use it to invest into stocks wisely…. It is a bad time to lend money on low interest rates, but a good time to borrow money wisely.

That being said, those who don’t leverage, you are advised to hold at least 20% cash on stand by. You are not in any danger.

Those who are leveraged, please keep a 20% - 25% buffer from your maximum margin so that you can withstand a 20 – 25% fall and BE in position to pick things up cheap. Keep a huge distance. If you don’t have that buffer suggest you take profit NOW.

Comments

Post a Comment