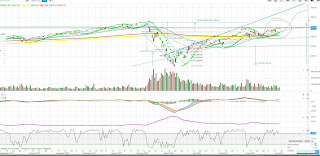

S&P500 Hits Resistance But LIkely to Break Higher

Much has been talked about a second wave and another lock down. Looking at the chart above, I think it is hitting a resistance but looking at the upward support line, it is likely to come down a little before breaking up.

It flies in the face of reality because the death rates are finally crawling up after the infection rates skyrocketed after the premature release of lock downs worldwide.

The death rate is now 606,788. I think we will hit between 1 to 2 million deaths when this virus finally dies off. Meanwhile, another lock down will cause even more bankruptcies and job losses.

Already, the lock down has released the automation genie out of the bottle and I feel that 20% of the economy will never be the same. In the sense that due to the work from home, buying habits, places that we live in will change. Imagine a company forced to buy laptops for all their staff to work from home. In order to recoup the costs, many companies will enforce hot desking, giving up 20% of office space.

The investment in automation will also cause companies to trim more staff. The number of foreign workers that Singapore relies on to cut grass, landscaping, construction, will mean that due to the pandemic, the government will consider using more machines to do the work.

The push to automation has just speeded up.

Commercial space demand will fall by 20% and may take 5 to 7 years to return to pre Covid levels. Air travel will fall by 40% and may take 2 to 3 years to return. Business travel may permanently fall by 20 - 50%.

The best case scenario is for a vaccine to be found. Life can go back to normal quickly.

But otherwise, there's always the central banks helping with liquidity, dolling out money for every household. The money will flow to the stock and property markets. Since governments are taxing the hell out of property investors via additional stamp duties, most of the money will flow to stocks.

By right without the central banks' actions on 23 March, stock markets worldwide would have fallen by 80% and rebounded by half the amount by now. It should still be 20% below the pre-Covid levels.

But with the monetary expansion, we could see a new S&P500 high. I'm still very bullish on the tech and healthcare sector. I think real estate for storage, warehousing, data centre and residential will do very well. Online retail yes. Automation yes. But be careful of banking.... All the old economy stocks will be badly hit.

Comments

Post a Comment