Tech Sell Off Has Begun

The second wave has begun. Make no mistake. Some cities are going to lock down again.

https://www.youtube.com/watch?v=sV5dh1W80Zc

https://www.cnbc.com/2020/06/25/countries-unlikely-to-impose-full-lockdowns-if-theres-second-wave-analysts-say.html

I doubt countries wil lgo through a full lock down like the first time. But it could be serious.

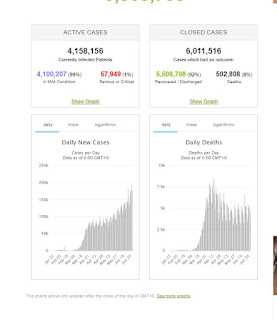

I mentioned in my earlier posts that infections are rising again, particularly in the Americas. But surprisingly, the "serious" cases have fallen to 1% out of 99%.

Death rates have held steady and I was hoping for the virus to mutate to something less deadly.

The second wave for Spanish flu was especially deadly, where most of the deaths occurred.

I suspect as hospitals become overloaded with patients, a "limited" lock-down will happen in affected cities. This is to "flatten the curve" due to limited hospital capacity. Death rates should climb but I doubt it will be greater than what we saw in the first wave. All being said, we may see between 1 to 2 million deaths when this blows over.

I'm beginning to see the first sell-down of tech stocks (see below). It makes me really happy as I'm now able to buy Alphabet, Microsoft, Amazon, Tencent, BABA, Meituan. Also Tesla, Square and Illumnia. All the stocks that ran ahead of fundamentals.

My asset allocation is around 50% equities, 20% long-tenor US Treasuries ETF, inverse ETFs. 10% alternatives like Silver and Gold. 20% cash.

https://www.youtube.com/watch?v=mJ4GYJMxIos

You can catch up on some of my views about this sell-down. Don't forget the Fed saying they will do "whatever it takes" to ensure price and economic stability. Notice the word, "Price stability". Asset prices like real estate, stocks and bonds? Hmmmm.

https://www.youtube.com/watch?v=sV5dh1W80Zc

https://www.cnbc.com/2020/06/25/countries-unlikely-to-impose-full-lockdowns-if-theres-second-wave-analysts-say.html

I doubt countries wil lgo through a full lock down like the first time. But it could be serious.

I mentioned in my earlier posts that infections are rising again, particularly in the Americas. But surprisingly, the "serious" cases have fallen to 1% out of 99%.

Death rates have held steady and I was hoping for the virus to mutate to something less deadly.

The second wave for Spanish flu was especially deadly, where most of the deaths occurred.

I suspect as hospitals become overloaded with patients, a "limited" lock-down will happen in affected cities. This is to "flatten the curve" due to limited hospital capacity. Death rates should climb but I doubt it will be greater than what we saw in the first wave. All being said, we may see between 1 to 2 million deaths when this blows over.

I'm beginning to see the first sell-down of tech stocks (see below). It makes me really happy as I'm now able to buy Alphabet, Microsoft, Amazon, Tencent, BABA, Meituan. Also Tesla, Square and Illumnia. All the stocks that ran ahead of fundamentals.

My asset allocation is around 50% equities, 20% long-tenor US Treasuries ETF, inverse ETFs. 10% alternatives like Silver and Gold. 20% cash.

https://www.youtube.com/watch?v=mJ4GYJMxIos

You can catch up on some of my views about this sell-down. Don't forget the Fed saying they will do "whatever it takes" to ensure price and economic stability. Notice the word, "Price stability". Asset prices like real estate, stocks and bonds? Hmmmm.

Comments

Post a Comment