Why A Second Wave of Infection Is Almost Inevitable, But This Is Not What Keeps Me Awake At Night!

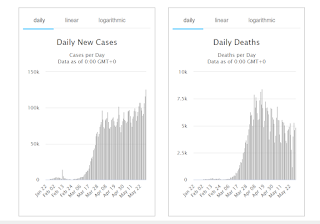

I am not a pessimist. By looking at the infection rates rising on the left graph, and the death rates falling on the right, I know that ultimately the right side will rise.

The western world is opening up their economies and I don't blame down. The world cannot shut down just to save a few. Ultimately, this virus will burn through the entire world's population and by end of 2021, perhaps about one to two million people will perish, over 60 million people infected.

A vaccine will probably be discovered by end of 2020. But it may take a year to reach Singapore.

https://www.bbc.com/news/health-52354520

This is where globalisation breaks down. Singapore thrives on globalisation, on the belief that countries will always trade with one another. However, we have seen countries closing their borders. We could not produce our own testing kit because we didn't have the manufacturing nor raw materials to do so.

https://www.bloomberg.com/news/articles/2020-05-08/singapore-s-nasal-swab-struggle-shows-why-test-kits-are-scarce

When a cure or vaccine is found, you can be sure that the more powerful, bigger countries will "chope" the medicines for their own people first. Because the faster the population is immune and cured, the sooner they can re-open the economy. It is a MATTER of life and death for the economy to bounce back.

What about food? This pandemic has not caused food prices to sky-rocket. But if supplies fall hard enough, mamy countries will ban the exports of food supplies to Singapore and we can be sure to suffer.

Global Warming

This is by far the biggest threat to mankind. Pandemics will come and go. A few millions may die each time. But nothing compares for the coming disaster that may wipe out mankind. Rising sea levels, lack of food, more pandemics will cause millions to be displaced, go starving.

The coming unrest in the next 10 to 50 years will be something we havent' seen in a thousand years.

AI

Artificial intelligence is another threat that we are too complacent.

https://www.youtube.com/watch?v=2DJmIjKtVkA

This is just the start of automation with brains. If we have robots that patrol parks to enforce social distancing, will they replace security guards and police? It will probably reduce the numbers needed.

About 30% of current jobs, from drivers to food processing plants will be replaced by robots. What will happen to the people displaced? It is not as if you can download 20GB of data into brains to change the skill set from driving to programming.

What Can We Do To Save Ourselves?

1. We should all eat a lot less meat. The carbon emissions from cattle is almost 30x more than eating plants. Besides, we don't need a lot of meat to survive and there are lots of alternatives like Tofu and eggs. Anything over 10% of our calories from meat will cause cancer rates to rise.

2. Eat a lot less carbohydrates and sugar. I have totally cut out all sugar, rice, gluten (wheat), noodles. I adopt a diet that's less extreme than Keto but it's called a low carb diet.

3. Overall, my proportions for daily meals are, 10% meat from animals / fish, another 10 - 20% from eggs, tofu. 50% vegetables for fibre. 10 - 30% carbs from fruits, sauces etc.

I drink my coffee sweetened by Stevia. That's zero carbs. I'm taking copious amounts of coconut milk, coconut oil. I've lost over 10kg over 6 months. I weighed 94.5kg in Aug 2019. By May 2020, today, I'm 82.5kg. I am 1.84m tall and have another 5 kg to lose. On top of that, my % body fat dropped from 20% to 14%. I used to be at 12% because I was a competitive swimmer.

https://www.youtube.com/watch?v=KHaCKudtVi0

Stop using fossil fuel

We all gotta move to hybrid cars, reduce our carbon footprint by using less plastics. This is something I find very challenging due to our convenience requires using a lot of carbon. But soon our lives iwll change. Either we find a win-win, eco-friendly lifestyles, or a drastic loss of living standards just to be carbon neutral.

Stock Markets

So far I’ve tried to teach you how to fish, not just where the fish is. I’ve also showed you my investment record for my CPF, which showed that I am making money.

Below is the IG Client Sentiment Report. It shows the average positioning of retail clients from IG. Most retail traders are net short. It is an inverse relationship. The more negative the news, the more opportunities open up for you to buy. The more positive the news is, the less chance there is. My very successful neighbor told me, “I will always make an offer to buy a property or two when the S&P500 is down by over 20%. I’ve been doing this for 30 years and each time there’s a disaster, I open my cheque books.” Well he’s quite wealthy and I’ve seen SOME of his properties and ONE stock account. He’s about 55 years old and goes to office just to surf the internet for the latest wine to import etc. I guess in a way he’s my role model. J

I’ve been busy house-hunting and buying shares / equity funds since 1st week of April.

Always learn from someone who is already “THERE”. That’s my motto.

Another mentor of mine, courtesy of “AK” said this.

As you can see only 22% of retail investors are net long and 78% of retail investors are net short in the S&P 500... thats why the market keeps going up! The market always goes OPPOSITE of the majority. The market is designed to hurt the majority of market players and enrich the minority. Think of the market like a bus. as long as few people are on the bus, the bus can fly up the mountain ... once too many people climb on the bus (majority start to get long), bus will overturn into the ravine

This may not apply to everyone. Those who are overly leveraged, you may wish to sell some shares to maintain a buffer of 15% of your gross assets so that you can withstand any correction again.

Those who just one income and are willing to forego capital gains, it’s a different strategy altogether.

Comments

Post a Comment