Warren Buffett is Selling Airline Shares, Insiders Buying

https://www.investors.com/news/warren-buffett-berkshire-hathaway-sells-delta-stock-southwest-stock-coronavirus/?src=A00220&yptr=yahoo

From the article above, the great investor seems negative on airline shares. It is a difficult enough being a cyclical business. Competition is ferocious. Now with this virus, air travel may take a long time to recover as people travel less.

https://sg.finance.yahoo.com/news/warren-buffett-coronavirus-outbreak-stock-market-volatility-oil-crash-125047574.html

Warren doesn't think this recession will be worse than in 2008 - 09. I feel that judging from what he says, he's probably busy buying shares.

https://www.drwealth.com/insiders-bought-more-than-70m-worth-of-stocks-in-march-2020/

The article from Dr Wealth confirms that all the successful, wealthy individuals are buying their company shares as well.

But the article below is important. Insider buying is often a good indicator of good value, and insiders' performance is often superior to outsiders, it is against a backdrop of an economic abyss.

https://finance.yahoo.com/news/coronavirus-economist-the-economy-has-fallen-into-the-abyss-134836246.html

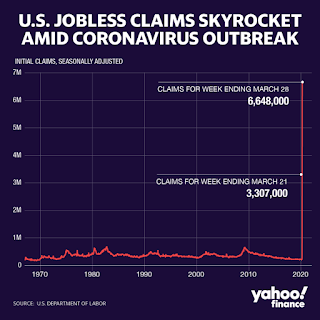

The US economy saw an unprecedented 6.648 million people applying for unemployment claims for the week ending March 2 when jobless claims came out on Thursday. On Friday the March jobs reports showed that the economy shed 701,000 jobs when economists were expecting a decline of 100,000. The global economy is in a similar shape as well.

In conclusion, while the insiders are buying, it is no guarantee that the bottom of stock markets have been reached. It indicates good value, I agree. But it could go down a further 20% before bottoming.

Right now, I'm neither adding shorts nor buying stocks / unit trusts. I'm sitting tight with 60% in cash.

From the article above, the great investor seems negative on airline shares. It is a difficult enough being a cyclical business. Competition is ferocious. Now with this virus, air travel may take a long time to recover as people travel less.

https://sg.finance.yahoo.com/news/warren-buffett-coronavirus-outbreak-stock-market-volatility-oil-crash-125047574.html

Warren doesn't think this recession will be worse than in 2008 - 09. I feel that judging from what he says, he's probably busy buying shares.

https://www.drwealth.com/insiders-bought-more-than-70m-worth-of-stocks-in-march-2020/

The article from Dr Wealth confirms that all the successful, wealthy individuals are buying their company shares as well.

But the article below is important. Insider buying is often a good indicator of good value, and insiders' performance is often superior to outsiders, it is against a backdrop of an economic abyss.

https://finance.yahoo.com/news/coronavirus-economist-the-economy-has-fallen-into-the-abyss-134836246.html

The US economy saw an unprecedented 6.648 million people applying for unemployment claims for the week ending March 2 when jobless claims came out on Thursday. On Friday the March jobs reports showed that the economy shed 701,000 jobs when economists were expecting a decline of 100,000. The global economy is in a similar shape as well.

In conclusion, while the insiders are buying, it is no guarantee that the bottom of stock markets have been reached. It indicates good value, I agree. But it could go down a further 20% before bottoming.

Right now, I'm neither adding shorts nor buying stocks / unit trusts. I'm sitting tight with 60% in cash.

Comments

Post a Comment