Market Update 27 Mar 2020. Twist and Shout

https://www.cnbc.com/2020/03/26/paul-tudor-jones-says-stocks-could-retest-lows-as-virus-peaks-but-will-be-higher-in-3-to-5-months.html

Above is an interview with Paul Tudor Jones. He said that it will be a "W" shaped recovery.

What a month it has been. I started out 90% long equities, 10% precious metal on 1 Feb. I gradually turned to 40% long, 5% precious metals, 30% shorts, 25% cash by end Feb. But I listened to the advice of a "guru" who insisted that I should buy at the 150 days moving average. I was actually up 5% even as the stock markets started to fall after Valentines' Day.

The investment nearly killed me. I managed to stop out all my long positions by 15 March. I went net short after 7 March and recovered some of my losses.

Today, I have reduced my shorts to just 10%, long 30%, cash 60%.

I believe that it will be a "W" or "U" shaped recovery. The economic impact of repeated lockdowns will be the most devastating since World War II.

Watch the video below. We are likely to see repeatedly lock downs as long as a cure or a vaccine hasn't been found and there are still infected people walking around.

https://www.youtube.com/watch?v=4kWXI8zMsGs&t=4s

Further commentaries:

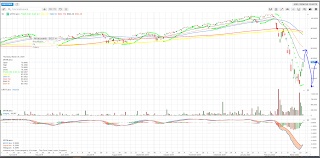

Scenario 2: We have not hit the bottom. The SPX is now doing a short term rally (on a downtrend) and would hit a level of resistance before taking the next leg down to a newer low (maybe at 42% of 50% from the top at 2,000 or 1,700 points on the SPX). I am watching the 2,643 level as the resistance as it coincides with the 20EMA and the previous horizontal support/resistance level.

Q1) Why would you buying stocks now if it is not a confirmed uptrend? Why would you buy stocks if there is chance of a next leg down?

Q2) Now the weekly MACD is negative. Why don’t you wait for a confirmed uptrend when the weekly MACD of SPX is positive again before you start buying

Above is an interview with Paul Tudor Jones. He said that it will be a "W" shaped recovery.

What a month it has been. I started out 90% long equities, 10% precious metal on 1 Feb. I gradually turned to 40% long, 5% precious metals, 30% shorts, 25% cash by end Feb. But I listened to the advice of a "guru" who insisted that I should buy at the 150 days moving average. I was actually up 5% even as the stock markets started to fall after Valentines' Day.

The investment nearly killed me. I managed to stop out all my long positions by 15 March. I went net short after 7 March and recovered some of my losses.

Today, I have reduced my shorts to just 10%, long 30%, cash 60%.

I believe that it will be a "W" or "U" shaped recovery. The economic impact of repeated lockdowns will be the most devastating since World War II.

Watch the video below. We are likely to see repeatedly lock downs as long as a cure or a vaccine hasn't been found and there are still infected people walking around.

https://www.youtube.com/watch?v=4kWXI8zMsGs&t=4s

Further commentaries:

For the first time in 3 weeks, the markets have had a back to back rally

The question on everyone’s mind is whether this bear market has hit bottom or is this just a short term rally before we make an even lower low

The reality is NOBODY knows. The best and richest investors in the world have no clue either. The good news is that we DO NOT need to predict the bottom in order to make our fortunes from this bear market

Scenario 1: We have hit the bottom. The recent SPX low of 2,192 marks a 36% drop from the all time high of 3393. In the last 100 years, the average drawdown over 21 bear markets is exactly 36%. What a coincidence! Also, notice that the low was formed by doing a classic double bottom (taking out stops placed) below the Dec 2018 low of 2,346

Scenario 2: We have not hit the bottom. The SPX is now doing a short term rally (on a downtrend) and would hit a level of resistance before taking the next leg down to a newer low (maybe at 42% of 50% from the top at 2,000 or 1,700 points on the SPX). I am watching the 2,643 level as the resistance as it coincides with the 20EMA and the previous horizontal support/resistance level.

My strategy is to continue adding to my core portfolio of stocks as long as I see their individual charts at levels of support and their prices way below the intrinsic value. I am gradually adding core stocks like Microsoft, Facebook, Alphabet, Amazon, Meituan Dianping. I've also gradually added funds like UBS China A Opportunities and First State Dividend Advantage instead of ETFs. I believe that ETFs own the most expensive stocks because they are market cap weighted. Those listed in the US also have 30% withholding tax on the dividends paid.

At the same time, as I am adding shares, I would watch these resistance levels. If I see bearish reversal candle being formed on resistance levels, I would add Put Option Spreads to generate short term profits during next leg down (if any) and also I have my covered calls to generate monthly premium whilst waiting for stocks to fully recover.

Some people would ask:

Q1) Why would you buying stocks now if it is not a confirmed uptrend? Why would you buy stocks if there is chance of a next leg down?

Yes, there is a ‘risk’ that prices could go even lower in the short term. At the same time, it is also a ‘risk’ that this is the bottom and prices go back to all time highs quickly and I miss this very rare chance to buy my fav stocks at such great discounts. There is a risk being in the market but a risk being out of the markets as well.

As an investor (versus a trader in this case), If I know for a fact that that MA will be worth $400-$500 in the future, does it really matter if I buy it at $230 and it goes down to $190 temporarily? If I know that the SPY will be worth $400 in the future, does not really matter if I buy it at $246 now, and it goes down to $200 temporarily?

Many retail investors have the fear of buying something only to see it being quoted lower later (they fear regret or the fear of being wrong). It is this fear that causes them to always want to pick them bottom. This irrational desire is what causes investors to miss the big picture and the huge gains that will achieve when the bull market arrives. As always, the bull starts when nobody expects it to start.

Q2) Now the weekly MACD is negative. Why don’t you wait for a confirmed uptrend when the weekly MACD of SPX is positive again before you start buying

Yes, USUALLY that is what I do.. However, this bear market is very unique. In this bear, prices have dropped so fast (in a straight line) that moving averages are lagging it too much. Prices are far away below their moving averages.By the time the weekly MACD turns positive SPX would have already moved up 15% to 25% off their lows, and stocks will no longer we undervalued.

In this unique case, I look instead to historical drawdowns based on past bear markets to determine an intelligent entry based on risk/return ratio or drawdown to gain ratio.

Based on past 21 bear market (100 years), the AVERAGE drawdown of SPX has been 36% to 42%. So if I enter at the 36% mark (which is the current bottom), I have a potential downside of 6%… but a potential upside of 56% to all time high.

Even if this bear market hits 50% drawdown (like the 2008 financial crisis), I have a potential downside of 14%… but a potential upside of 100% to all time high.

In a nutshell, for an investor, as long as you are buying a high quality company (that you know will increase in value over time) and you pay a price that is at a good discount to intrinsic value… you have done a good job! And you will be richly rewarded in time and with patience.

What happens between the time you bought it and the time in bears fruit really does not matter at all. It is a psychological fear (fear of not picking the bottom , fear of regret) that some of you need to get over to free your mind from the Matrix of the markets.

If I told you that a stock you bought today at $10 will definitely be worth $30 to $50 in the future, would you take the investment? Would you be happy? I am sure you will

What if I now told you that the stock went from $10 to $7 …before getting to $50. Would you now be upset? Does it really matter?

Food for thought

Comments

Post a Comment