Wuhan Virus and Stock Market Impact

It has been an eventful two weeks. I’ve hinted of a “significant correction” of between 6 to 10% in the coming weeks. Refer to my email on 9 Jan 20, also on 6 Jan 2020. Lessons to learn:

1. Nothing goes up forever and what goes up exponentially must come down fast. Take for example Bitcoin. It shot up from USD3000 to 20k. It promptly fell and gave up all the gains. All patterns repeat.

2. Stocks rise slowly but fall very swiftly.

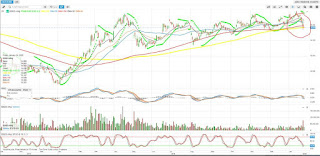

It had to happen and this Wuhan virus is a trigger. The supports for all stock markets and stocks are at around the 150 to 200 days moving averages. They generally are on the uptrend so I presume this bull rally is intact.

Most of my clients have taken some profit starting from last week till today. For China, the 2823 HK ETF is already at the 200 days MA and I don’t think we should sell now. In fact we should get ready to buy swiftly. Think of all the stocks like Alibaba, Meituan, Tencent that you never had the chance to buy. UBS China A Opportunity, probably too late to sell and it’s a fantastic fund.

Longer term, China has a lot to go. The highest in the last 5 years is around HKD17 and it is now 14.80. There is around 15% upside. Valuations now are cheaper than back in January 2018. The correction for Asia / Emerging Markets are almost over. The upside to downside risk is now > 2x and I will not panic and sell now.

Outside of Asia, most developed countries’ indices have more to fall. The S&P500 is still around 6.3% away from the 150 days and a further 8% from the 200 days. I would say that this correction isn’t over for the west.

At this point, I will be shorting western equity indices, buying some gold and silver.

The virus may have a few more weeks to go before infection rates stabilizes. It is proving far more virulent than SARS.

At the end of every global epidemic is a major market rally!

On Thursday, January 9, 2020, 5:41 PM,

This is just for sharing, not product specific advice. I’m sharing what I would do in various situations.The first video clip is a tongue in jest. “21” was one of the greatest movie I ever watched. It ranks up there with “Wall Street”, “Wall Street, The City Never Sleeps”, “Margin Call”, “The Big Short”, “Boiler Room”. 21 is a true story about a team of MIT students who learned to “count cards” for Black Jack. In the 80s and 90s, casinos use fewer packs of cards and it is much easier to count that the croupier has produced many “small cards” like “2” and “5”. Croupier / dealer is likely to produce a larger card lie “King”, “Queen”. This will increase the chances of that the next card drawn will be a large one and force the dealer to go past “21”. The house will then lose.Investing is a little like card counting. We can tell if the markets are due for a pull back if the price deviates too far above the moving averages. Conversely if the price pulls below the moving averages by too much, we know it’s time for a rebound.There is likely to be a 6.5% correction for the Emerging Markets index towards the 150 days MA. It is not a big correction. It is likely to be a short and sweet pull back.For S&P500, it is likely to be 7.7% towards to 150 days MA. That will be a great time to enter the markets.Longer term, the monthly chart just showed that a long, bull trend has just started for most major markets, Asia, Emerging Markets, Europe and the US.

On Monday, January 6, 2020, 4:37 PM,

The S&P500’s returns cluster around 0 to 30%. In 2018, it was -4% for the first time since 2008. It was followed by 29% in 2019. For 2020, the S&P500 is unlikely to achieve the same 20 to 30% return. But note that after one negative year, it is usually followed by 2 to 3 positive years. The returns for S&P500 is likely to be either 0 – 10% or 10 – 20%. A more subdued but still positive return compared to 2019.Finally, this is just a probability and things can easily turn far more bullish or bearish depending on events. We can only act based on what we see. I won’t be adding many US stocks from here, only selective China companies. Below is a quote from Warren Buffett about forecasting.“We've long felt that the only value of stock forecasters is to make fortune-tellers look good. Even now, Charlie and I continue to believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children” - Warren Buffett, Legendary Investor

Comments

Post a Comment