If 2018 is a Bad Year for Equities, Will 2019 Be a Good One?

economists make the worst investors

Economists make the worst investors. I've been an economist in the past. Forecasting is often difficult because the further you try to forecast, the less accurate it is. To make things worse, economic growth often have no bearing on stock performance. This is because stocks are a forecasting machine. When growth is at the highest, the only way is down, stocks already predict a slowdown nine months down the line.

I believe in statistics, measuring investor flows. If 2018 is a bad year for global equities, especially for the EM, then 2019 will be a fantastic year. The odds are very high that this will happen. The best performing asset class in one year will often not continue to be the best the next. There are exceptions of course, but generally, the theory of mean reversion of valuations applies.

If an asset were to be undervalued due to a sell down, chances are value investors will buy. Price will find a support and eventually, momentum investors come in. Retail investors will come in last. Similarly, if an asset is a top performer, it is likely to be over valued. value investors will sell, followed by momentum investors.

if 2019 is a good year for equities, will 2020 be a good one too? I doubt so.

the US GDP growth is slowing down. ECB, which is 3 years behind the US' economy cycle, is likely to start to hike in 2019. by 2021 ECB should be at the peak. we could see a global recession in 2022, a synchronised one where the US, EU are down. this means that global stocks are likely to have a good 2019, a so-so in 2020, but maybe a bear market in 2021.

This has got to be the longest bull run for the S&P500 and Dow Jones in history. From 2009 to 2020. 11 years! This economic cycle has been punctuated by several bear markets in emerging markets and Europe, in 2011 (PIIGS and European crisis), 2015 (oil and gas industry collapse) and 2018 (trade wars). But the US has emerged the winner and the strongest economy in the world this time.

arsenal 1 liverpool 1

I'm watching Arsenal vs Liverpool as I'm watching this. 1-1. the result is fair. I love emergy, Arsenal's new coach. I was a proponent of wenger's sacking as i felt he lost his touch since 2007. Wenger's teams lack tactics, discipline in defence, character and mental strength. The French man is more of a politician, someone who manages well upwards, sideways and down. but in footballing sense, he's clueless. from 2013 onwards when arsenal started to spend more, arsenal's performance actually dropped, which exposed wenger's failings.

https://www.bloomberg.com/news/articles/2018-11-02/markets-are-steadier-but-investors-have-plenty-to-worry-aboutMarkets

Investors Have Plenty to Worry About as Market Clouds Gather

By

Updated on

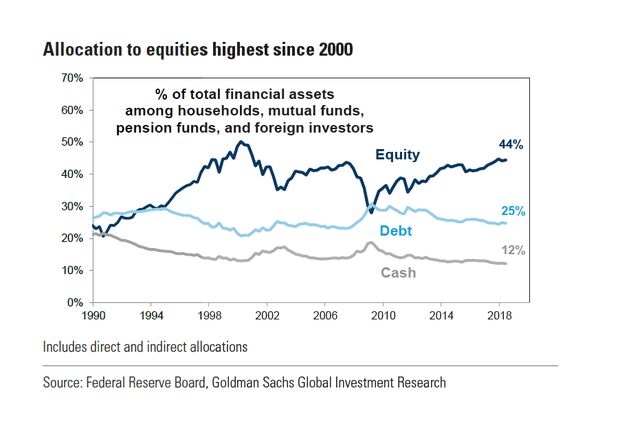

- Goldman says allocation to equities highest since tech bubble

- Concerns rise about Fed overshoot, bond yields, capital flows

How Wall Street Views the October Jobs Report

Just when you thought we were past the worst of it.

Markets were finally managing to rally after October’s tumble. The S&P 500 may have fallen 10 percent from its record to its worst levels in the month, but this week it logged three straight days gaining more than 1 percent. In the backdrop is a U.S. economy that is firing on all cylinders, as shown by Friday’s strong payrolls report.

But on the horizon, multiple factors are converging that could signal trouble for markets into next year. U.S. business economists see a recession coming by the end of 2020. JPMorgan Chase & Co. said Oct. 26 that equities turn sometimes only when the economy enters recession, though also sometimes a year before the slump -- so they are looking at potential for a rotation to defensive positioning around mid-2019.

Even after the market’s recent turmoil, some positioning still appears stretched. Allocation to equities is the highest since the tech bubble, while cash is at a record low and allocation to debt is below average, according to a Goldman Sachs Group Inc. report Thursday from strategists led by Arjun Menon, who said they expect investors to reduce portfolio risk in 2019.

Then, there’s geopolitics. JPMorgan strategist John Normand said Thursday in an interview that the number of material political and geopolitical risks “seems to be quite high going into the next year,” which he attributed partially to the way President Donald Trump’s administration approaches its policy objectives.

With the Federal Reserve expected to continue to raise rates in 2019, some have started to worry that tighter conditions will encroach on growth.

Morgan Stanley’s Andrew Sheets and Cantor Fitzgerald LP’s Peter Cecchini are also watching the Fed, with Sheets writing on Oct. 28 that the Fed was unlikely to come to the rescue of equity investors.

“The odds are increasing for a Fed overshoot,” Cecchini wrote Thursday. “A burgeoning global slowdown (in emerging markets and Europe) combined with a weakening U.S. housing market, will result in higher volatility in 2019.”

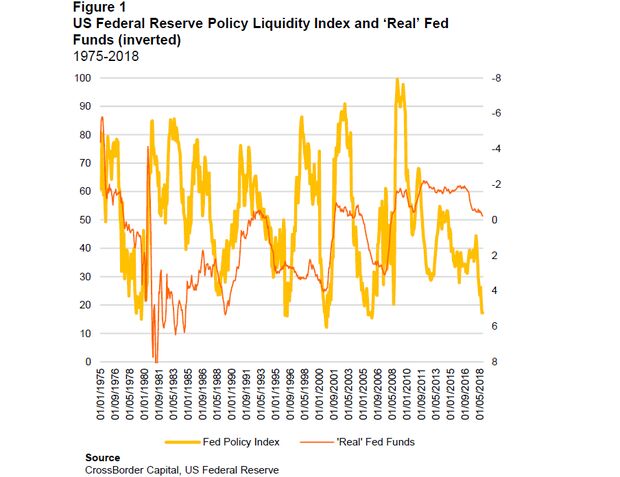

London-based CrossBorder Capital weighed in as well.

“We have been concerned throughout this year that the U.S. Fed is hitting the brakes harder than widely believed because rate hikes are occurring on top of balance-sheet shrinkage,” CrossBorder wrote in a note emailed Friday. “Reliable bond market metrics point to the real risk of an upcoming slowdown, while the recent collapse in investors’ risk appetite warns that an economic inflection point is close.”

Treasury yields could be problematic, as well. Societe Generale SA strategists led by Alain Bokobza on Wednesday recommended cutting allocations to U.S. equities, as higher bond yields are starting to have an impact. They think a 10-year U.S. Treasury yield of 3.25 percent could take the S&P 500 to around 2,482, which would be almost a 10 percent drop from Thursday’s close. The 10-year was recently around 3.20 percent.

“A break back over 3.25 percent definitely could spark some equity angst,” Dave Lutz of JonesTrading Institute wrote Friday.

Then there are the changing global dynamics.

“Set against crashing global liquidity, we are concerned that the recent huge build-up of $4 trillion of speculative foreign capital in U.S. financial assets flags an upcoming U.S. dollar sell-off in 2019,” CrossBorder wrote in a separate report Friday. “A major realignment of global capital towards Asia and away from the U.S. looks to us underway, fueled by future growth opportunities and the prospects of higher profits from Chinese expansion into Central Asia.”

Of course, many experts don’t see these issues coming to a head for some time. As of late August, the median forecast for the S&P 500’s year-end level was 3,000, according to strategist predictions compiled by Bloomberg. That would be about a 9 percent gain from yesterday’s close.

“With selling disconnected from strong fundamentals and positioning turning more attractive, we maintain our view this sell-off is temporary and see equity upside into year-end,” JPMorgan strategists led by Dubravko Lakos-Bujas wrote on Friday, reiterating a view from the firm earlier in the week suggesting potential for a “rolling squeeze” higher.

But the clouds are building on the horizon, and investors would do well to watch for signs of further trouble.

“If you’re going into a year where there are reasons to be concerned about the business cycle itself,” with “geopolitical risk” on top of that, Normand said, “it should make you concerned about where markets are going to be.”

Comments

Post a Comment