Why A Second Wave of Infection Is Almost Inevitable, But This Is Not What Keeps Me Awake At Night!

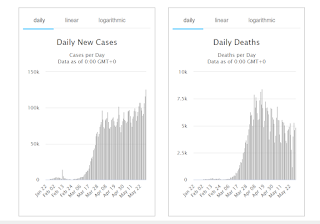

https://www.worldometers.info/coronavirus/ I am not a pessimist. By looking at the infection rates rising on the left graph, and the death rates falling on the right, I know that ultimately the right side will rise. The western world is opening up their economies and I don't blame down. The world cannot shut down just to save a few. Ultimately, this virus will burn through the entire world's population and by end of 2021, perhaps about one to two million people will perish, over 60 million people infected. A vaccine will probably be discovered by end of 2020. But it may take a year to reach Singapore. https://www.bbc.com/news/health-52354520 This is where globalisation breaks down. Singapore thrives on globalisation, on the belief that countries will always trade with one another. However, we have seen countries closing their borders. We could not produce our own testing kit because we didn't have the manufacturing nor raw materials to do so. https://www...