Unprecedented Crisis Looming.

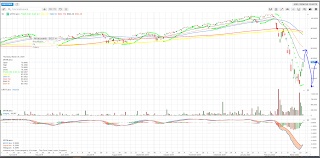

https://www.economist.com/graphic-detail/2020/03/14/control-of-the-coronavirus-gives-china-the-worlds-best-performing-stockmarket Looking at this website, I'm not comforted at all that China is the best performing stock market. It is scant consolation when the rest of the world falls by 70% and China falls by 50%! Here's the problem: this is unprecedented in modern history. There may be a series of lockdowns, not ONE lockdown. It may not end until either a vaccine or a cure is found. Vaccines and cures are at least 12 months away according to experts. https://www.youtube.com/watch?v=4kWXI8zMsGs&t=510s Watch Fallible above. As long as a few people are walking around with the virus, it will spread very quickly. In the 1930s, the Dow Jones Index collapsed 70%. That was during the Great Depression. This is likely to be a sharp Great Depression that lasts 12 to 18 months, until a cure is found. It is likely to be shorter but sharper than the Great Depression. The Lock ...