Residential Rents Plummet in Major UK Cities

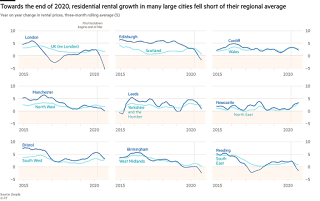

https://www.ft.com/content/2d81120b-da42-4e3e-a165-8fc20f415cbd Rents are falling fast in major cities across the UK as a result of coronavirus, which has caused demand for properties from overseas workers, students, tourists and corporate travellers to plummet. The falls are most pronounced in London, the city in the UK most exposed to the demand shock unleashed by the pandemic. But rents in Manchester, Birmingham, Edinburgh, Leeds and Reading have also tumbled in recent months, and are unlikely to rebound quickly, according to data from property portal Zoopla. In the 12 months to October, average rents in London fell 6.9 per cent; in Birmingham they slipped 3.2 per cent; in Reading 2.2 per cent and in Edinburgh 1.7 per cent. All cities in the analysis fell below their surrounding region, reflecting weak demand for accommodation closer to town centres. Rents had continued to grow in Leeds and Manchester through much of the pandemic, but both dipped into negat...