Model Portfolio Review 31 Aug 21

Dear friends

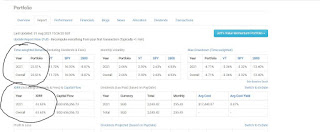

The model continues to achieve good returns. It is up 23.51% from Mar 23 2021. XIRR 61.63%. My next mission is to transfer this performance wholly or at least in part to you. It compares positively to S&P500 which is up 16.93%. It is very difficult to beat the S&P500, so I have to stay very grounded, very humble, very nimble, always pushing to improve myself and discover new secrets to portfolio management.

In the last 30 days, the portfolio is up 3.64%, against 3.35% for the S&P500.

Top performers: Ethereum up 26.2%, Mercado Libre 19%, SEA ltd up 18%. Bitcoin up 17.8%. Nvidia up 14.9%. Shanghai International Airport up 14% (YES, finally, ONE china stock rises).

Over last 7 days, Shanghai Airport is UP 11%. JD.com up 6.6%. I believe JD may have turned positive! Sea ltd up 6.4%. TSMC up 6.1%. ASML up 4.2%. Facebook up 4.1%. The portfolio is up 1.11% vs S&P500 up 0.95%.

Significant trades for the past week:

- Took ¼ profit off Adobe. At 661. Gone exponential in the chart.

- Took ¼ profit off Alphabet at around 2843.70. Gone exponential in the chart.

- BOT Intercontinental Exchange at 117.21. ¼ position

- SOLD ½ position on CROMWELL REIT. Keeping ½. This is a technical signal.

- BOT ¼ in Lowe’s. 202.85. Strong back to old school consumer spending.

- BOT Mapletree Log Trust. ¼ allocation. 2.05

- BOT mapletree ind Trust. ¼ allocation. 2.88

- BOT JD.com ¼ allocation. 240.80

- Took ¼ profit S&P Global. Chart went exponential. 442.39

- Bot ¼ allocation to US Healthcare IHF at 263.80.

- Took profit sold ¼ allocation in Johnson & Johnson @ 179.92.

Comments

Post a Comment