Portfolio Review as of 22 Aug 21. Surviving the China Stock Crash

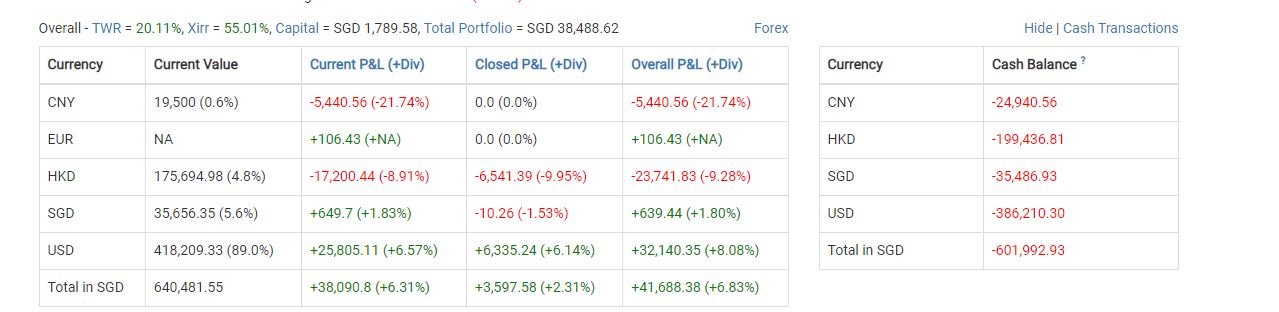

I am both relieved and humbled that my model portfolio has continued to outperform S&P500. It is up 20.11% from 23 March 2021. Against 16.14% for S&P500, Vanguard World Stocks with 10.51% and Hong Kong Tracker -10.27%.

I added an inverse 3x China ETF, YANG in view of the declining trend, plus 3x Emerging Market inverse ETF, EDZ. Both trades paid off and enabled the portfolio to outperform S&P500. These are merely trades and I will only apply them to markets which are on a medium term decline.

I've also reduced my China exposure drastically to minimise the damage.

From the chart below, you can see that the outperformance started in May 2021 and was stretched further from July 2021 onwards. I've added further tech stocks and reduced my China exposure.

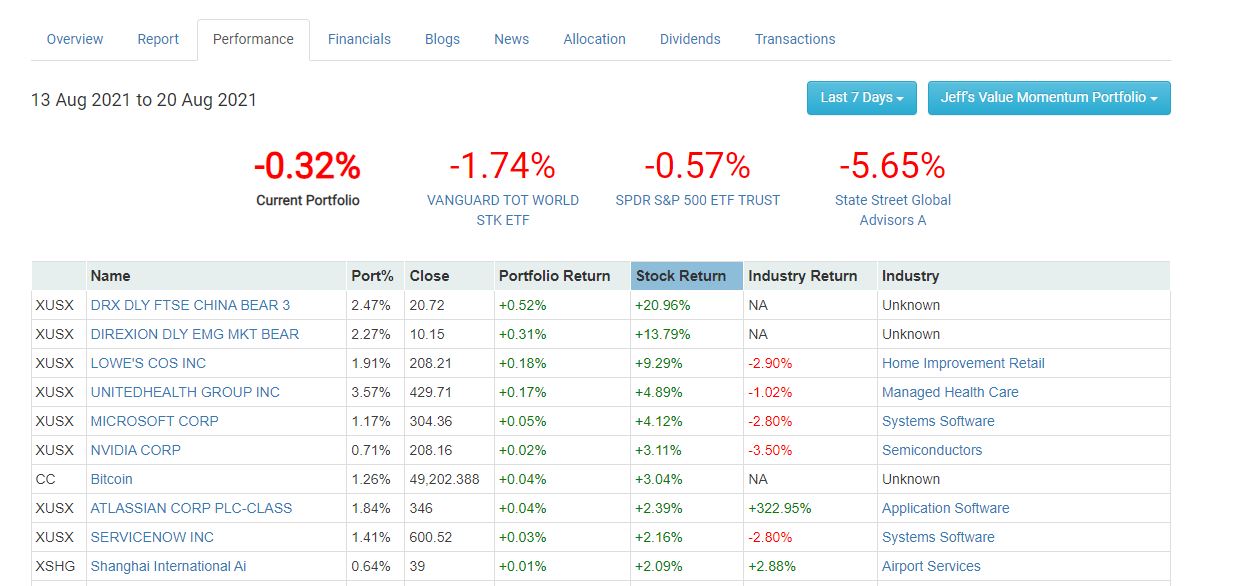

In the last 30 days, the portfolio has outperformed the three indices. it is up 3.39%. The top performers were:

1. Ethereum +64.7%

2. Bitcoin up 52.7% (both Cryptos were momentum plays)

3. Direxion 3x China BEAR "YANG ETF". This is a trade and expresses my bearish view short term of Chinese equities.

4. Atlassian Corp or TEAM. This is a momentum play and is up 28.7%

5. Microstrategy is up 28.7%. This is a speculative play and a proxy to Bitcoin.

Significant transactions for the week of 22 Aug:

1. Initiated a BUY on 3x Emerging Market bear, EDZ at 9.16.

2. Initiated a BUY on 3x China bear, YANG at 17.86.

3. BUY European ETF, IEV at US$55. The equivalent for a fund is Blackrock European Fund which has outperformed the ETF by 3 percentage points or more consistently.

4. BUY MSCI World, URTH at 130.31. The equivalent is Morgan Stanley Global Brands, BNY Mellon Global Equities Fund.

5. Sold ALL my ARK Next Gen ETF. This is but a trade. Price 148.58

6. SOLD ALL my ARK Innovation ETF. Again this is a speculative, momentum trade. Price 119.30

6. BUY Boeing at 227.14.

7. BUY Unitedhealth Group at 407.33

8. BUY Lowe's at 189.2

9. BUY FICO at 443.

10. Buy 3M at 200.38.

11. BUY Prime US REIT at 0.84.

Comments

Post a Comment